Can weather index insurance help farmers adapt to climate change?

The Inspire Challenge project, “Seeing is believing,” leverages advances in information and communications technologies and data processing in order to improve insurance services for smallholder farmers.

The COP25 talks will have focused mainly on how to mitigate and adapt to an average temperature increase. However, climate change also means that extreme weather events such as floods, droughts, and cyclones are growing in frequency and intensity. We should not ignore the behavioral impacts of these events when modeling or predicting the effects of climate change. Going a step further, effective climate change policies should focus not only on adaptation to changing temperatures in the long run, but also on adaptation to the increasing incidence and intensity of weather extremes.

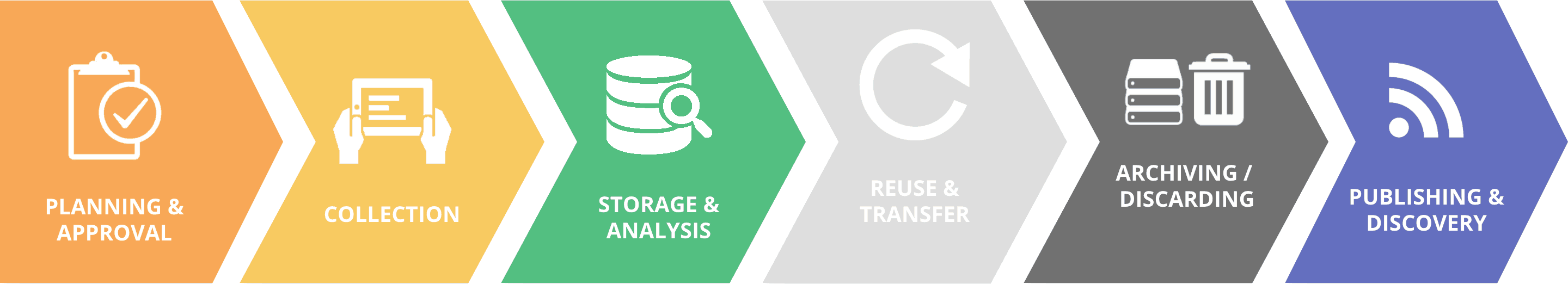

Weather index insurance is a promising adaptation instrument in this regard: Losses and payouts are determined using measured variables such as rainfall, and insurance companies don’t have to send claims adjusters out to assess damages. Participating farmers can purchase insurance at relatively low cost that can help them recover from floods and other disasters and lower various forms of risk.

Weather extremes can have long-lasting impacts on smallholder farmers’ livelihoods through at least two channels. First, they destroy assets and production, and to make up for the lost income households may resort to costly coping strategies such as borrowing at high interest rates or reducing investments in children’s education—all of which compromise future household welfare. Second, even the mere possibility of weather extremes can have severe consequences, as risk discourages investments in agriculture. This risk ex ante—without the shock necessarily occurring—reduces welfare by a substantial amount, even relative to the welfare losses from shocks themselves.

So, effective adaptation policies should promote instruments that help households cope and recover from weather extremes ex post, but also help them in reducing their exposure to risk and increasing their investments ex ante, so that the policies deliver value even during good years without a shock. How can we improve the ways smallholder farmers manage these two different aspects of risk?

Data availability is one key effort where CGIAR organizations can work with the insurance industry.

Insurance schemes struggle with an absence of data—for instance, data on rainfall and crop yields needed to develop indices and monitor risks. Information and communications technologies (ICTs) and advances in data processing offer new opportunities to improve the quality of index insurance and reduce basis risk.

Innovations could come, for instance, in the form of monitoring crop losses using high-resolution satellite imagery, drones, or ground photography. At IFPRI, we are testing picture-based insurance: Farmers send the insurer photos of their own fields, taken on the ground, to document damage. Initial findings suggest that incorporating these pictures in claims helps improve demand and reduce basis risk, and improves crop monitoring, even relative to metrics derived from high-resolution satellite imagery.

Learn more about how this Inspire Challenge project “Seeing is believing” is working to improve insurance services for smallholder farmers.

December 13, 2019

Berber Kramer

Research Fellow

International Food Policy Research Institute

Latest news